Bidenomics: Big Government, Industrial Policy and Centralized Control

Article by Kevin Stocklin from our premium news partners at The Epoch Times cross-posted with permission.

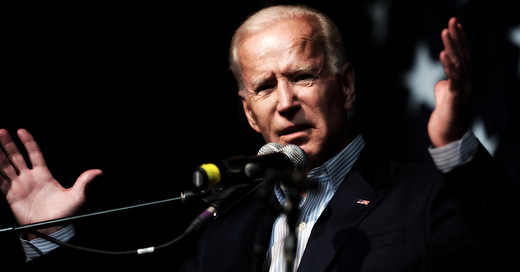

With an eye toward the upcoming presidential elections, the White House has launched a new public relations campaign called “Bidenomics,” to define President Joe Biden’s economic agenda.

“I don’t know what the hell that is, but it’s working,” Biden stated at a June 17 union rally in Philadelphia, begging the question: what is Bidenomics, and is it working?

According to a White House statement, Bidenomics rests on three pillars: massive “smart” government spending on renewable energy and semiconductors, support for unions and domestic manufacturing, and promoting competition. As a result, the White House states, “our economy has added more than 13 million jobs—including nearly 800,000 manufacturing jobs—and we’ve unleashed a manufacturing and clean energy boom.”

The Creating Helpful Incentives to Produce Semiconductors and Science (CHIPS) Act of 2022 allocates $280 billion in federal spending to bolster U.S. semiconductor manufacturing. The Infrastructure Act of 2021 allocated more than $65 billion for “clean energy” projects. And the 2022 Inflation Reduction Act allocated an additional $394 billion for clean energy in the form of tax incentives, loans, and grants.

“I would define it as trickle-down big government,” Jonathan Williams, chief economist at the American Legislative Exchange Council, told The Epoch Times. “The common thread of this administration has been growth and expansion of government power, and certainly big government spending.”

According to National Security Advisor Jake Sullivan, when Biden took office, “America’s industrial base had been hollowed out. The vision of public investment that had energized the American project in the postwar years—and indeed for much of our history—had faded.“

Sullivan, who, despite his focus on security issues, has become a spokesman for Bidenomics, has been highly critical of what has been called “Reaganomics,” or a platform of tax cuts, trade liberalization and deregulation.

“There was one assumption at the heart of all of this policy: that markets always allocate capital productively and efficiently,” Sullivan said during an April speech at the Brookings Institution.

“President Biden … believes that building a twenty-first-century clean-energy economy is one of the most significant growth opportunities of the twenty-first century,” he stated. “But that to harness that opportunity, America needs a deliberate, hands-on investment strategy to pull forward innovation, drive down costs, and create good jobs.”

Despite the administration’s argument that government is best positioned to direct private industry, some critics say that waste and failure are the hallmarks of government industrial policy.

Political Investors

“The government is not in the business of making good investments,” economist Arthur Laffer, a former advisor to Presidents Ronald Reagan and Donald Trump as well as U.K. Prime Minister Margaret Thatcher, told The Epoch Times. “That’s not what they should be doing,” he said.

“These guys are not good investors; they’re political investors,” Laffer said. The more the government seeks to influence the private sector, the more the private sector will orient itself toward producing what the government wants versus what consumers want.

“Bidenomics is nothing more than the application of government intervention to guide, direct and restructure the economy as the White House thinks it should be structured,” Steve Hanke, economics professor at Johns Hopkins University, told The Epoch Times.

“This type of interventionism flies under the rubric of ‘industrial policy.’ It’s where government picks winners and losers by using levers of government policy, like taxes subsidies, regulations, tariffs, quotas, and even outright bans.”

Recent examples of government ventures into private industry include Solyndra, a California maker of solar panels that received $535 million in federal loan guarantees from the Obama administration before going bankrupt.

Under Bidenomics, automakers are being pushed by a combination of consumer subsidies, manufacturing grants, and ever-tightening emissions regulations to switch their production from gasoline-powered cars and trucks to electric vehicles (EVs). However, there is scant evidence that enough consumers will switch to EVs to justify the investments or that carmakers will be able to source enough lithium, cobalt, and other minerals to build EV batteries in large quantities, or that the U.S. electric grid can build enough new generation capacity and connect enough charging stations to charge EVs at scale.

At the same time, the Biden administration is working to reduce domestic production of oil, gas, and coal in favor of wind and solar, with the same supply issues that automakers face. The required minerals for wind turbines and solar panels are typically mined in countries that may not be friendly to the United States, and it has created a heavy dependence on China, which controls most of the refining of these minerals.

According to Hanke, who served on Reagan’s Council of Economic Advisors, “Bidenomics is nothing new. Advocates of industrial policy in the 1980s used to latch onto Japan as a model for industrial policy, arguing that it contributed to Japan’s emergence as an economic power after World War II.

“But since the last three lost decades in Japan, the industrial policy advocates have gone radio silent,” Hanke said. “It’s hard to imagine a more misguided way to make decisions than to put them in the hands of those who pay no price for being wrong.”

Trillions in New Spending

To date, the Biden administration has overseen more than $4 trillion in new spending, of which $1.6 trillion was passed by Congress on a partisan basis, $1.4 trillion was passed on a bipartisan basis, and another $1.1 trillion came from Biden’s executive actions. Despite this spending, the White House claimed in March that “the President’s Budget improves the fiscal outlook by reducing the deficit by nearly $3 trillion over the next decade.”

The Congressional Budget Office (CBO) sees it differently, however.

“Under the President’s FY 2023 budget, the debt would grow be allowed to grow by $16 trillion over ten years, or $50,000 of debt per American citizen,” the CBO reported in March. “Under CBO’s current projections, the gross federal debt would increase from $31 trillion today (123 percent of GDP) to $52 trillion (132 percent of GDP) in 2033.”

“Probably the worst part of Bidenomics is the enormous increase in spending,” Laffer said. “I never could have guessed anyone would have overspent like that.

“If you look at the national debt-to-GDP or any other measure, it’s gone way, way up,” he said. “This is an egregious reversal of what would be good economics.”

Tax Policy Under Biden

“Forty years of handing out excessive tax cuts to the wealthy and big corporations had been a bust,” Biden stated. By contrast, Bidenomics “is about building an economy from the bottom up and the middle out, not the top down.”

While most of the tax hikes that Biden called for have so far failed to get through Congress, critics argue that Americans have experienced significant tax hikes nonetheless, due to another economic phenomenon to carry the president’s name: “Bidenflation.”

“The inflation that has come in under Biden has pushed capital gains tax rates way up, because we have illusory capital gains that are now subject to capital gains taxation,” Laffer said. Because of inflation, he said, the nominal value of assets has increased dramatically, even though in terms of purchasing power “it’s the same thing.”

This results in a “tax on the illusory capital gains,” he said. Inflation has also pushed Americans into higher income tax brackets, despite the fact that wage gains often failed to keep up with rising prices, leaving Americans poorer but facing higher tax liabilities.

“If you look at the corporate rate, it’s still what it was when Trump left; and as you look at the personal income tax rates, 37 percent is still the highest,” Laffer said. “But if you look at all the inflation induced tax rate increases, they’ve been quite substantial.”

And this is in addition to the effective tax of inflation itself, which drives up the cost of goods and services as the dollar loses its value. Inflation was cited as the main reason why 76 percent of Americans polled in an Associated Press-University of Chicago survey in May had a negative view of Biden’s economic policies.

“There’s nothing that can bring the economy to its knees faster, and more damagingly, than an unhinged paper currency and high inflation,” Laffer said.

Under Bidenomics, the White House asserts, “America has seen the strongest growth since the pandemic of any leading economy in the world. Inflation has fallen for 11 straight months and has come down by more than half.”

As is often the case with statistics, however, the time period you consider colors what the numbers show. While the official inflation rate, according to the consumer price index (CPI), came down from a high of 9.1 percent in June 2022 to the current rate of about 4 percent, it remains well above pre-pandemic levels of below 2 percent.

Many attribute escalating prices to unprecedented levels of government spending, coupled with policies that discouraged the production of oil and gas, driving up the cost of gasoline and diesel, fertilizer, food, and transportation, although the Biden administration has blamed the Russian invasion of Ukraine.

The story is similar to economic growth under Biden. After U.S. GDP fell by 2.8 percent in 2020 due to the COVID-19 pandemic and government lockdowns, America’s economy roared back to a positive 5.9 percent GDP growth in 2021 once lockdowns were lifted and businesses rushed to rehire laid-off workers.

Following this burst, however, the United States has underperformed against most other industrialized countries. While the average global GDP growth rate for 2022 was 3.1 percent, according to the World Bank, the U.S. GDP growth rate in 2022 lagged behind the rest of the world at 2.1 percent. Among “leading economies,” the U.K.’s GDP grew by 4.1 percent; France’s by 2.6 percent; Sweden’s by 2.6 percent; Spain’s by 5.5 percent; Mexico’s by 3.1 percent; and Canada’s by 3.4 percent. Germany, at 1.8 percent, was one of the few industrialized countries that underperformed the United States.

Notably, GDP also includes government spending, which hit record levels under the Biden administration.

Employment Remains a Bright Spot

According to the White House statement, “under Bidenomics, the unemployment rate fell below 4%,” and the abundance of jobs is certainly one of the bright spots of the current economy. Here too, however, critics say there are clouds.

The labor participation rate, which is the percentage of able-bodied people seeking work, hit a high mark just above 67 percent in the year 2000. It fell to a low of 62.5 percent in 2015, before climbing back to 63.3 percent in 2020, under Trump. It then plummeted to 60 percent during the pandemic and is currently at 62.6 percent under Biden, the same level as during the Obama administration.

Many blame an expansion of social programs and unemployment benefits for the number of Americans leaving the labor market. This also makes the unemployment rate seem lower because those not even seeking work are not counted in unemployment statistics.

“Encouraging people not to work has reduced the unemployment rate, that’s true,” Laffer said. “It’s also reduced the participation rate. It’s reduced both the employment rate and the unemployment rate, which is the antithesis of what we want in a healthy economy.”

Gravy Train for the Super-Rich

Biden claimed that tax cutting under Reagan only benefitted the rich and “hollowed out the middle class.” By contrast, a central pillar of Bidenomics is “empowering and educating workers to grow the middle class,” according to the White House statement.

But some economists argue that Biden has it backwards, that government intervention makes the private economy even more of an insider game at the expense of everyday Americans.

“The one thing we know for certain about big government and more government spending is that it provides a gravy train for the super-rich, rent-seeking class,” Hanke said.

“The surge in government spending over the last five years has resulted in a huge jump in U.S. billionaires’ wealth, from 15 to 18 percent of GDP,” he said. “So much for the equity arguments that are draped over Bidenomics.”

“The best way to make profits today in the private sector is to lobby the government for a contract or a regulation to help you,” Laffer said. “If you tell a business that was profit-focused, that you can make the most profits by lobbying government, of course, they’re going to do that.”

Regulation and Centralized Authority

The other major component of Bidenomics is a sharp increase in government regulation. This includes new draconian emissions regulations from the Environmental Protection Agency (EPA), new appliance regulations from the Department of Energy (DOE), and new Securities and Exchange (SEC) requirements for producing audited reports on CO2 emissions for all listed companies.

A June report by the Committee to Unleash Prosperity estimated that the added costs of new Biden administration regulations, “which include both their current and expected future costs, amount to almost $10,000 per household.” By contrast, the Trump administration reduced regulatory costs on Americans by $11,000 per household, the study stated.

The report stated that, as reported by federal agencies themselves, the cost of new regulations they were implementing under Biden summed to $173 billion per year, although the report estimated that the costs were actually much higher, at $616 billion per year.

Beyond costs, critics charge that the Biden administration has been particularly aggressive in attempting to centralize authority within federal agencies at the expense of local government.

“One of our greatest criticisms of this administration’s policy agenda is that everything has the common thread of trying to federalize decisions in Washington, and central government versus allowing the states to compete with each other,” Williams said. The Biden administration is “changing the incentive structure for many states in favor of a big government agenda.”

Historically, American states have been free to compete with each other on policies, and this has allowed for experimentation in terms of what works best. Business and workers typically respond by investing in and relocating to states that provide the most attractive conditions in terms of living costs, tax rates, regulations, and quality of life, and the last several years has seen a flood out of progressive states like California, New York, and Illinois, in favor of conservatives states like Texas and Florida.

“[Biden’s] policy agenda has been to undermine state autonomy and federalism wherever possible, whether that is federalizing elections, banning state right-to-work laws [or] telling states you can’t cut taxes if you take federal bailout dollars,” Williams said. “The Biden administration has flooded state budgets with unprecedented amounts of federal aid.

“While that federal aid is temporary, the strings that are attached to it are not temporary.”

Article cross-posted from our premium news partners at The Epoch Times.

ANALYSIS: Bidenomics: Big Government, Industrial Policy and Centralized Control

“Bidenomics is nothing more than the application of government intervention to guide, direct and restructure the economy as the White House thinks it should be structured,” Steve Hanke, economics professor at Johns Hopkins University, told The Epoch Times.

https://www.theepochtimes.com/bidenomics-big-government-industrial-policy-and-centralized-control_5373031.htmlutm_source=Goodevening&src_src=Goodevening&utm_campaign=gv-2023-07-04&src_cmp=gv-2023-07-04&utm_medium=email