There’s a Big Warning Sign That Commercial Real Estate Is in Trouble

Article by Will Kessler from Daily Caller cross-posted with permission.

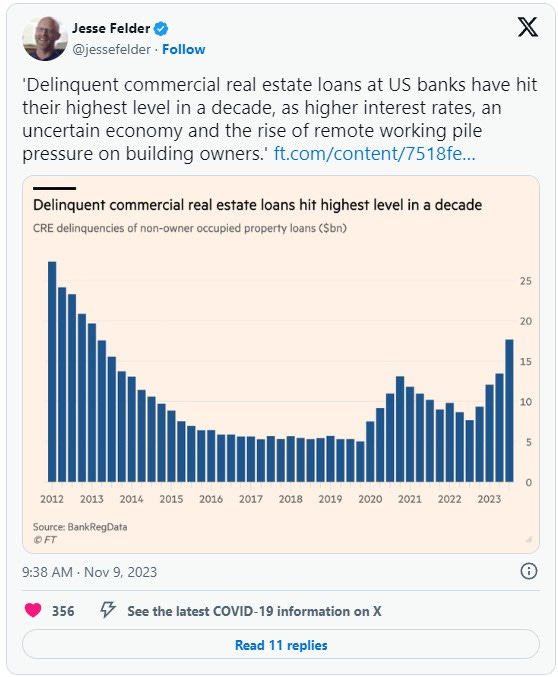

(Daily Caller)—Commercial real estate is facing an exceptionally high number of foreclosures on high-risk loans, an indicator that the sector could face even more foreclosures in the future, according to The Wall Street Journal.

Lenders issued foreclosure notices for 62 high-risk loans in the commercial real estate sector for this year ending in October, double last year’s total and possibly the highest number ever, according to a WSJ analysis. Many of those foreclosures are from mezzanine loans, or high-risk property loans that allow for a shorter time to foreclosure and have higher interest rates, with the shorter time frame giving a more immediate pulse on the health of the sector and forecasting a possible wave of foreclosures in the future on more traditional loans.

“A lot of borrowers have basically said, ‘I can’t hold this asset any longer; I can’t keep putting money in,'” Terri Adler, managing partner at the law firm Adler & Stachenfeld, told the WSJ. “And the lenders have said, ‘OK, we’ll take it back.'”

Commercial real estate foreclosures, while still presently low, are a lagging indicator of the sector’s health, as there can be a gap of a few months to years between a default and a foreclosure on more traditional loans, according to the WSJ. The total dollar amount for mezzanine loan foreclosures, despite the increase, is not known as the loan type does not appear on property records due to its opaque nature.

Regulators have forced bigger banks to be more cautious since the 2008 financial crisis, where a bubble in the real estate market burst after banks issued an exceptional number of risky loans, leading to the recent rise in mezzanine loans, which avoid this regulation to fill that demand for riskier loans, according to the WSJ. Smaller banks, debt funds or nonbank lenders fill this gap with mezzanine loans that entice lenders with interest rates often above 10%.

Mortgage rates reached a recent peak near the end of October at 7.9%, the highest point since September 2000. Residential home affordability has also suffered, with the average American only being able to afford a 30-year mortgage on a $356,273 house as opposed to that same family being able to afford a $737,392 house in December 2020.

Interest rates across all forms of debt are facing upward pressure from the Federal Reserve’s federal funds rate hikes. The rate has been put in a range of 5.25% and 5.50%, a 22-year high, following a series of 11 hikes in an effort to combat inflation, which peaked at 9.1% in June 2022.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.

People are also resorting to alternative homes like mobile homes (Manufactured) they can put on their own land that they can add a home garden, and have room for young children to play, further out of big crime-riddled cities. A single wide equals a starter home with 3 bedrooms and 2 baths. Put a shed with it for storage. If you are handy enough much can be DIY projects. US News https://realestate.usnews.com/real-estate/articles/how-much-does-it-cost-to-buy-a-mobile-home

Forbes https://www.forbes.com/advisor/mortgages/mobile-home-cost/

I do Not recommend a mobile home park, due to the size of the lots, costs, restrictions, and they tend to be in lower-class neighborhoods today. I advised to buy a new unit. Older are at the point of needing repairs. And yes I've lived in a brand new single-wide we had to put in a mobile home park which was fairly nice, but time passed and it went downhill. Which had too many downsides or rules to it.

Or RV motorhomes that vary in size for those who want more mobility. They come in both gas and diesel. Check your area. https://www.generalrv.com/product/motorhome

Costs vary by state and location. You need what suits your needs and wallet. Florida is one of the largest areas for either type. They are attractive to seniors' needs.